NAVIGATING THE HOUSING MARKET IN SPRING 2024

April 4, 2024

ACTIVE HOME LISTING UPDATE

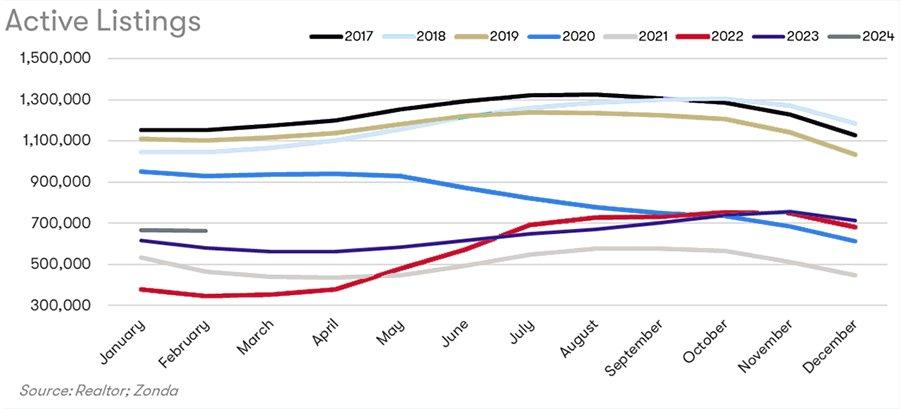

Wolf began by discussing the ongoing challenges in existing home sales, which have not significantly rebounded in the past 18 months. Listings in February were the highest for any February since 2020. The 15% increase is a great overall sign for the future, but sales are still down by 26% compared to 2019, a decline attributed to issues with affordability, consumer confidence and particularly, inventory levels.

Although there was a 24% year-over-year increase in listings as of March 2024, inventory levels were still 38% lower than pre-pandemic figures, indicating a slow recovery and ongoing supply constraints.

REGIONAL DISCREPANCIES

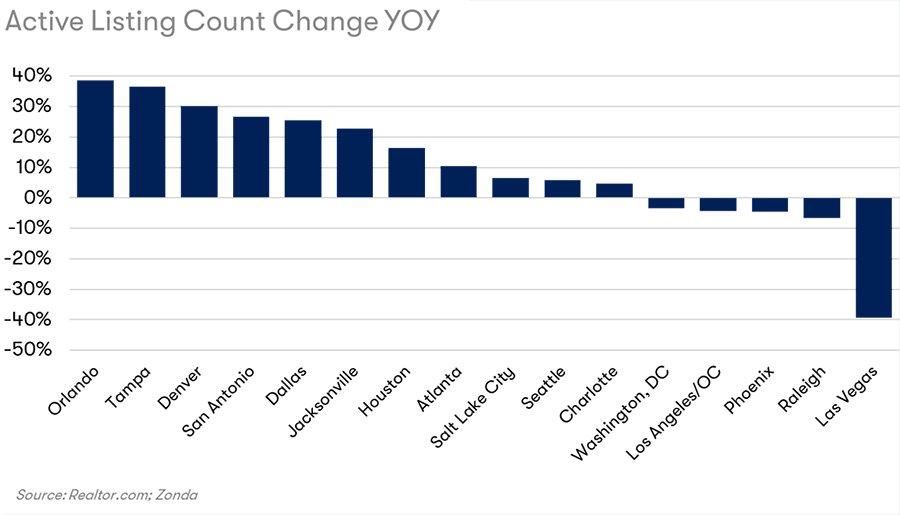

Focusing on regional differences, Wolf highlighted Texas and Florida where inventory levels have notably risen over the past year, driven by factors such as escalating insurance costs and property taxes. In contrast, cities such as Phoenix, Raleigh and particularly Las Vegas, have experienced a decline in active listings over the last year.

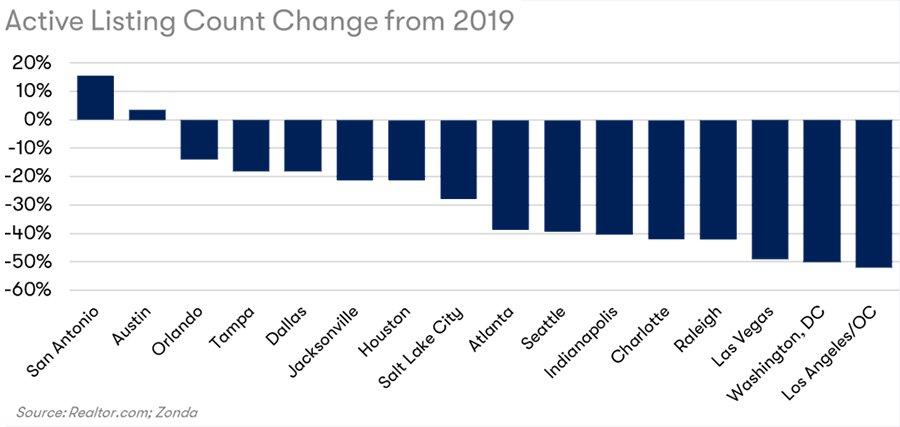

While the current trends are positive, there is still progress to be made to reach pre-pandemic levels of active listings. Wolf noted that some markets like San Antonio and Austin have performed well, consistently above their 2019 numbers. In contrast, most other major cities are still below their 2019 levels, underscoring the uneven recovery across the United States.

THE RISE OF NEW HOME SALES

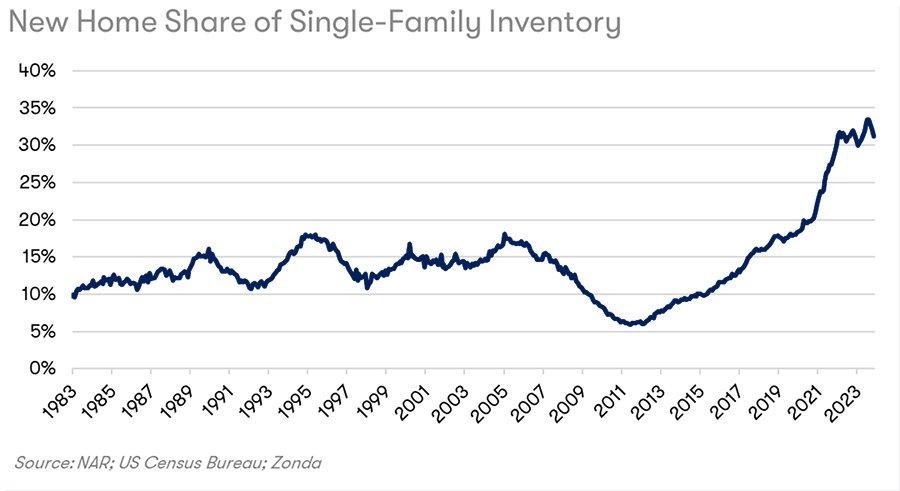

The new home segment has seen substantial growth, now accounting for 30% of total housing inventory, up from the traditional range of 10-15%. This increase is driven by the slow replenishment of existing homes available on the market, as well as a shift in buyer preference towards new constructions, as they are perceived to require less up-front maintenance and include more modern features.

THE SURGE IN QUICK MOVE-IN HOMES

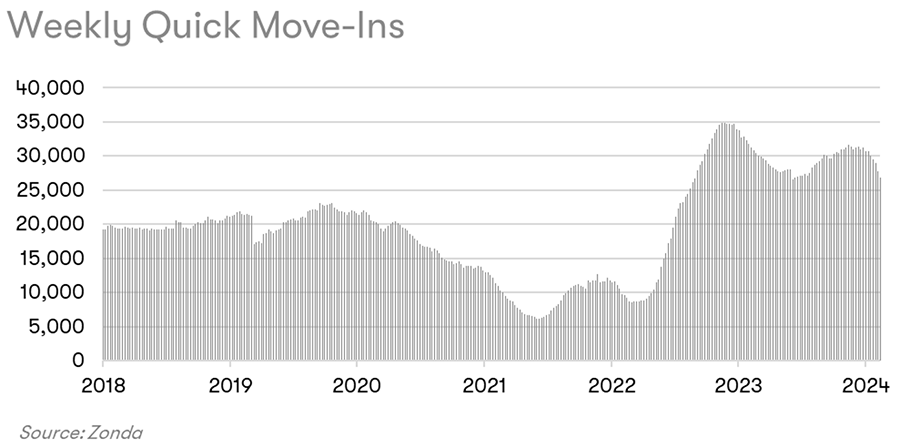

Wolf discussed how quick move-ins are not only accelerating transactions but are also helping to stabilize prices by providing immediate supply to meet the high demand. People relocating for work or better living conditions often seek readily available homes, impacting both sales and pricing dynamics.

Another major benefit to new homes is an opportunity to move in more quickly than when going through the closing process on an existing home with a private seller. These homes are becoming a pivotal factor in the market as they cater to the urgency of buyers who are ready to transact without the usual wait times associated with new constructions.

As you can see in the chart below, quick move-ins surged in 2022 and have remained high since then. They are down 14% compared to this time last year, but still up 26% compared to 2019 levels.

LAND ACQUISITION AND LOT DEVELOPMENT

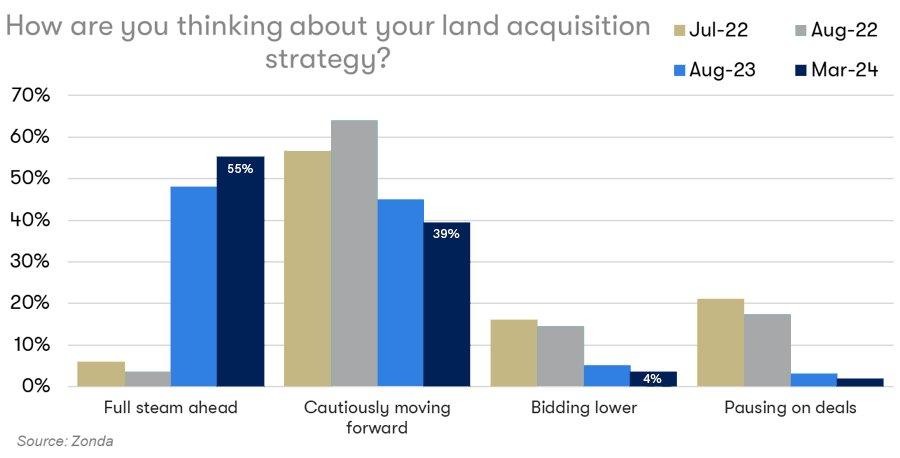

The discussion highlighted that 55% of builders are aggressively pursuing land acquisition, with a significant rise in land prices for two consecutive months. This proactive approach to land acquisition is essential for meeting the demand in high-growth areas and supports robust housing starts. The availability of developable lots is crucial, especially as builders aim to increase community counts despite regulatory challenges and supply chain issues.

THE MULTI-FAMILY SECTOR

The multi-family segment is experiencing a different trajectory, with an anticipated drop in starts by about 26% this year compared to last. This reduction is influenced by flattening rents, supply concerns, and financing challenges. However, the demand in top markets like Dallas, Houston, and Atlanta remains strong, highlighting regional differences in housing starts and the need for tailored approaches to multi-family development.

LOOKING FORWARD

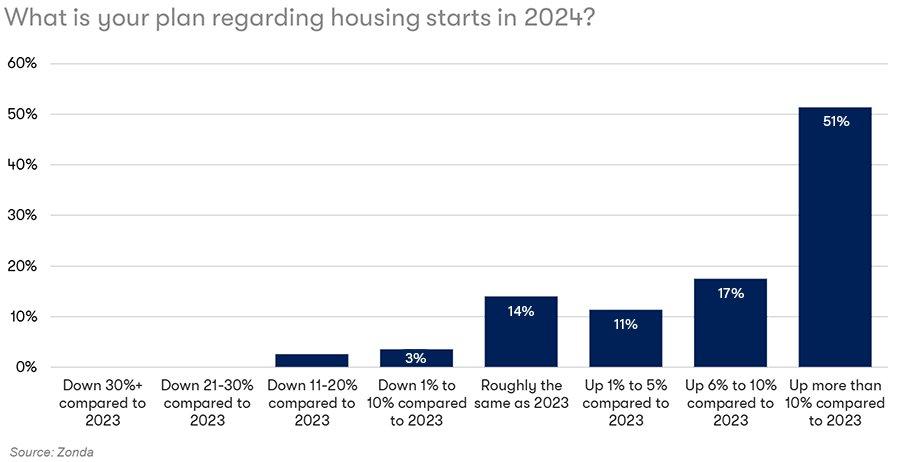

Towards the end of the webinar, Wolf provided forecasts for the housing market, projecting cautious optimism. She noted that 78% of builders plan an increase in housing starts for 2024 compared to last year, and 51% anticipate an increase of over 10%.

Wolf provided a forecast that anticipates ongoing challenges with inventory and affordability. However, she also expressed optimism about the easing of some pressures through increased new home construction and innovative housing solutions. She also anticipated that the market would continue to experience segmentation based on regional and sector-specific trends.

For stakeholders and anyone looking to understand or engage with the housing market effectively, understanding these nuances will be crucial in navigating the market’s complexities and capitalizing on emerging opportunities. Builders FirstSource is committed to providing high-level market information to our customers, so stay tuned for more webinars later this year.